Thorsten Bausch

Traveling back from an interesting and lively VPP meeting on a train at dawn through beautiful, lonesome parts of Germany, full of large forests hosting mythical creatures that made it into the fairy tales of the Grimm Brothers, I felt somehow elated. So let me use this momentum to refresh our spirits by debunking three popular myths.

1. Bielefeld exists

I can now positively and finally testify that Bielefeld exists. Doubts about its existence have been spread for many years and even made it to Wikipedia, where reference is made, among others, to none less than Chancellor Frau Merkel. Be that as it may, I have now been to Bielefeld and have seen it with my own eyes. What a joy!

Bielefeld is actually surprisingly large, having about 340,000 inhabitants of whom I happen to know about three. It is also fairly old – founded around 1240 to secure the famous Bielefelder pass (altitude 120 m) within the equally famous Teutoburg Forest – and pretty lively. Admittedly, not everything there is pretty, but the conspicuous ugliness of many buildings of this city may at least serve as a useful reminder that it is (a) a damned stupid idea to allow an authoritarian movement to usurp power in a democracy and to start a war and (b) it pays to invest in good architecture. I should also caution innocent visitors about one of its local mineral waters, which contains no less than 950 mg/l sulfate and 421 mg/l calcium – i.e. almost 1.4 grams of gypsum per liter. And believe me, you can taste that!

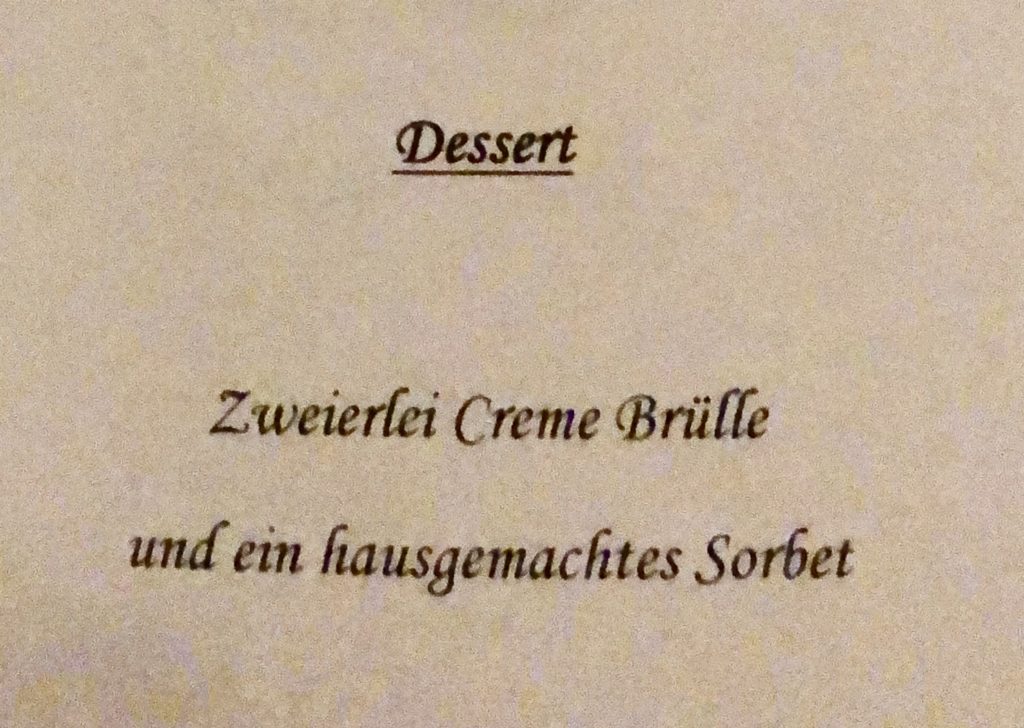

Other than that, Bielefeld is well-known for its innovations in the food sector. Just take the following delicious dessert as an example

Which was designated in our (German) menu as

With this, I hereby declare the myth/conspiracy that Bielefeld does not exist as debunked. It is an enjoyable city and, as I have shown above, at least some of its citizens have a good sense of humor.

2. The EPO is not poor

A similar myth that seems to pervade through the heads of the EPO management every other year is that the EPO’s finances are not in good shape and that, as the current Office President put it, “we might face a gap”.

We might indeed, who can deny that? But the relevant questions are (i) when and (ii) under which circumstances/assumptions?

The answers are (i) in 20 years, and (ii) the underlying assumptions are subject to significant controversy, to put it mildly. To put them into context, I would just like to offer three observations. Firstly, the current (2019) financial study was considered necessary, because the predictions of the last one (2016) did apparently not sufficiently match reality. As stated in the study on page 9 (sic!):

“… some events could not fully be anticipated in 2016: a low interest rate environment persists, and the production and productivity of the Patent Granting Process have evolved faster than anticipated. Additionally, annual benefit payments will be higher than contributions to RFPSS sooner than expected.”

Secondly, the study itself acknowledges that

Forecasting a 20-year development of the EPO’s financial position is inevitably a very uncertain exercise, as these positions will be impacted by factors which cannot be predicted with certainty. Therefore, four scenarios were developed…

Thirdly, I have read the 2018 success report of the Battistelli administration and am slightly confused, because this report states the following:

The measures taken by the Office to increase productivity and available capacity generated an additional 30% in income from procedural fees between 2010 and 2017. As a result of higher performance, the standardised operating result of the Office grew from EUR +70 million in 2010 to EUR +394 million euros in 2017. Standardised employee benefits – which have generated great liabilities for the office in the past – have been brought under control. In 2010 those expenses represented almost 80% of the total revenue but have been reduced to around 66% presently. High cash surpluses have been generated in the 2010-17 period (EUR +2.4 billion) and the EPO is now in a stronger overall financial position both in its ability to finance future liabilities and in its treasury.

So everything was in order and “brought under control” in 2018 (so that the past President earned his extra bonus (???)), but only one year later a new study is presented wherein doubts regarding sustainability in 20 years are expressed. (Can one claim the bonus back?)

With this, let us turn back to reality. According to the EPO’s most recent figures (page 9 of this PDFinance_Presentation), the Standardised Operating result in 2017 was a surplus of €366 million. In the year 2018 it was €390 million, a plus of about 6% (don’t ask me why these figures are slightly different from the ones published in the Battistelli report). The productivity of the examiners (Products per Examiner) has likewise increased from 95.5 (2017) to 99.8 (2018) products per headcount. Thus, it indeed seems that the EPO has become more effective (as it was planned by the Battistelli management – note that I am not talking about quality here) and made an operating profit that I would describe as pretty breathtaking.

On top of that, the EPO Treasury Investment Fund (EPOTIF) which was established and activated in 2018 under external asset management control has assets of €2,4 billion, that is 2.400.000.000 EUR. If my understanding is correct, most of this money has been invested on the stock market in shares and bonds. Whether this is right or wrong may be a matter of debate, but the net effect of this policy in the year 2019 was clearly positive: Namely, whereas general interest rates were about zero, both stocks and bonds had a pretty good year and (so far) increased by about 8% from 1 January. Which adds another approximately 200 million EUR to EPOTIF’s asset sheets. Sounds great – but is this sustainable?

I have argued before that I do not perceive it as the core objective of a patent office to make huge profits. In the end, a patent office is to serve the common good, i.e. promoting technological progress by thoroughly examining patent applications and granting patents to those inventions that deserve it. In contrast, it is not a patent office’s task to impose additional liabilities on applicants in the form of fees, just to put the excess earned by these fees on the stock or bond market. It goes without saying that the European Patent Office should be self-financing and receive the money it needs for operating its business and paying the agreed staff pensions to its retired employees, and I have no doubt that the Administrative Council will provide the office with those means by allowing it to raise the necessary fees at any time. (Whether the EPO needs much more than that, e.g. to pay its past President an appreciable extra premium in addition to his generous salary or to sponsor lavish inventor of the year ceremonies, is another matter on which I have commented earlier.)

In any case, I would summarize that it is a pure myth that EPO is “poor” and that active measures would therefore be necessary to cut costs, particularly staff costs and pensions. On the contrary, staff has demonstrably become more effective, so if anything, I would argue that they have rather deserved a reward.

On this basis, it is quite difficult to see a gap anywhere in the EPO’s figures which would justify immediate action. Predictions about the long-term future are notoriously difficult and highly dependent on the assumptions underlying them, which therefore need to be thoroughly scrutinized and discussed. If my understanding is correct, most of the scenarios under which a “gap” has been prognosed seem to assume a global economic recession and slump in the stock market (“decline in equity earnings”) within the next few years, followed by a slow increase. There is also an optimistic scenario under which there would be no predicted gap at all. All of this may or may not happen, I don’t know. With my limited economic understanding, I just wonder one thing: If EPO management seriously believes in any of the more gloomy-gap predictions and thinks it is appropriate to invest a large proportion of both its investment fund and its pension fund on the stock market, would it not be wise to shorten the stocks now, thus generating a buffer, and re-invest after the slump?

In any case, I am confident that the construction of the EPO will continue to allow it to reliably generate the income it (really) needs in any given year. This is even enshrined in Article 40(1) of the EPC:

The amounts of fees … shall be at such a level as to ensure that the revenue in respect thereof is sufficient for the budget of the Organisation to be balanced.

Nonetheless, I think it would be appropriate not to close one’s eyes to the general demographic trends in Europe and the level of salaries and pensions of employees at the national patent offices in Europe and world-wide. If the EPO’s (alleged) long-term funding gap is largely due to the prediction that pension payments will triple by 2038 under the current pension scheme, it is probably legitimate to first check the basis of this prediction and then evaluate whether the current pension scheme is sustainable in the long run, or whether something should be done about it, and if so, what. Both is probably pretty complex, and I lack the economic foundations and financial figures to express any insightful opinion at this moment.

With that, a final comment on quality, allegedly the EPO’s highest priority. How can a patent office secure high quality of its “products”? Two measures stand out, in my view: (a) recruit highly qualified staff and (b) enable, educate and motivate it to provide high quality work. Common sense tells you that it will be difficult recruiting highly qualified staff if you are not providing adequate pay (including pensions) and job security to begin with. Common sense may also tell you that it will be difficult motivating staff to provide high quality work if you suggest 17 measures for discussion to the Budget & Finance Committee and the Administrative Council of which 10 (and the ones designated as most effective) go at the expense of your staff. If anything, this may be expected to have a boomerang effect on motivation. The recent strikes (more are planned) and demonstrations organized by the EPO’s Staff Union therefore come to me as no surprise. There must be a better way to initiate and conduct such a discussion.

Can I perhaps offer a “social litmus test” in this regard? I would expect that any measures cutting into salary and/or pension increases would be much more acceptable if it is made transparent and credible that the same measures will proportionally (or better: over-proportionally) also be applied to top management. For example, why not think about capping the maximum salary and/or pension at a certain (reasonable) level?

3. There are Positive Developments in the IP World

A third myth that I would like to debunk here is that there are never any new and good developments in the EPO and the Federal Patent Court. Again, not true! There are at least two pieces of good news that I would like to spread here.

Firstly, I have heard that there have finally been some positive developments at the EPO in regard to amicably settling the disciplinary actions against several past board members of SUEPO. Some of these cases have apparently been finally settled; in others negotiations seem to be more seriously conducted than in the past years. Having asked for such amicable solutions for a while, I very much welcome this (overdue) development and hope that the successful conclusion of all cases will remove a considerable stumbling block that existed in the relations between EPO management and its staff.

Secondly, the German Ministry of Justice also deserves a round of applause, since it has finally approved the filling of several vacant positions of (technical) Judges at the Federal Patent Court. I have heard that legislative measures to accelerate German nullity proceedings are also under way. All in all, and combining this with the sudden end of the smartphone wars, I am now much more optimistic that the current backlog of the Federal Patent Court will gradually disappear over time.

So there is also positive news to report from time to time and it seems that common sense has not completely disappeared from this world. With that, happy Halloween, United Kingdom and all readers!

More from our authors:

|

Vissers Annotated European Patent Convention by Derk Visser, Laurence Lai, Peter de Lange, Kaisa Suominen € 105 |

|

Japanese Patent Law: Cases and Comments by Christopher Heath, Atsuhiro Furuta € 181 |

|

Patent Law Injunctions by Rafal Sikorski € 181 |